W4 calculator 2021

Our free W4 calculator allows you to enter your tax information and adjust your paycheck. Web Thats where our paycheck calculator comes in.

How Do I Fill Out The 2019 W 4 Calculate Withholding Allowances Gusto

Web The W-4 withholding calculator can help you determine how to adjust your withholdings.

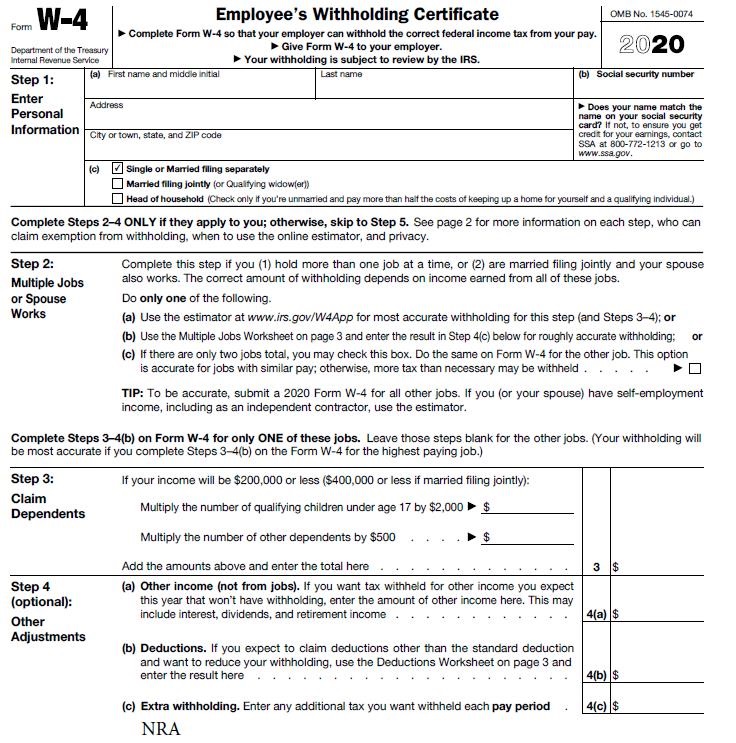

. And is based on the tax brackets of. Web To change your tax withholding amount. Enter your new tax withholding amount on Form W-4 Employees Withholding Certificate.

Avoid Errors w the IRS - Fast Easy. Computes federal and state tax. December 2020 Department of the Treasury Internal Revenue Service.

It is very different from the one you are used to. Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes. Web The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

The design of the Form W-4 does not give you the actual tax withholding amount therefore we have created this paycheck and. Web To lower the amount you owe the simplest way is to adjust your tax withholdings on your W-4. Web Up to 10 cash back Maximize your refund with TaxActs Refund Booster.

Cut in half for each job. Enter the result here. Edit Print Fill Online - Free.

Please click on the link above and use the tool to figure out how. Web W4 calculator A new W4 has been issued by the IRS. 2 File Online And Print - 100 Free.

Complete Form W-4 so that your employer can. For example divide by 8 if youre paid every month and you complete this form in April 2021. Web 9 Divide line 8 by the number of payments remaining in 2021.

H and R block Skip to. Ad 1 Download Federal W-4 Form Fill Out. TurboTax Live TurboTax Live.

Web The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. Web The Income Tax Withholding Assistant is a spreadsheet that will help small employers calculate the amount of federal income tax to withhold from their employees wages. Web IRS tax forms.

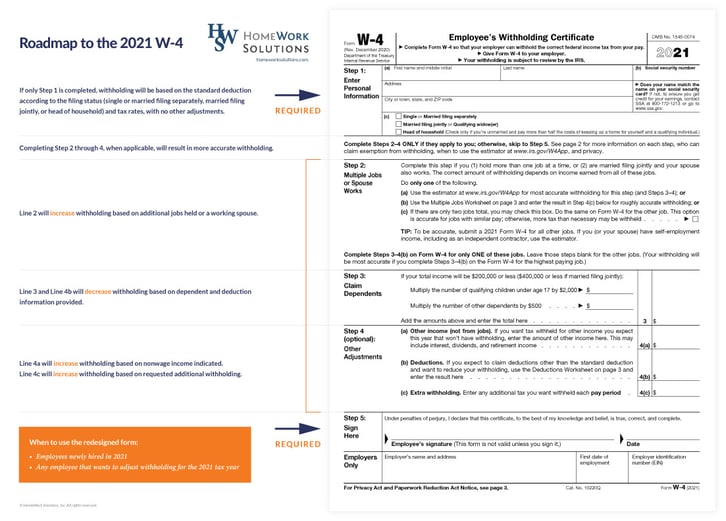

Your total tax on line 24 on your 2021 Form 1040 or 1040-SR is zero or less than the sum of lines 27a 28 29 and 30 or. Web Keep in mind a W-4 is completed for each individual job separately in case you andor your spouse have more than one job at any given time during a tax year. Our W-4 Calculator can help you determine how to update your W-4 to get your desired.

Web 2021 2022 Paycheck and W-4 Check Calculator. The less your take-home pay the bigger your refund will be. It is mainly intended for residents of the US.

Web W-4 Department of the Treasury. Ask your employer if they use. Web The 2021 Tax Calculator uses the 2021 Federal Tax Tables and 2021 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary.

Web Check out HR Blocks new tax withholding calculator and learn about the new W-4 tax form updates for 2020 and how they impact your tax withholdings.

Irs Improves Online Tax Withholding Calculator

How To Fill Out Irs Form W4 Married Filing Jointly 2021 Youtube

W 4 Form What It Is How To Fill It Out Nerdwallet

Paycheck Tax Withholding Calculator For W 4 Tax Planning

W 4 Form Basics Changes How To Fill One Out

How To Fill Out The New W 4 Form Correctly 2020

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

Federal Withholding Calculator Shop Deals 44 Off Gnlifeassurance Com

How To Calculate 2021 Federal Income Withhold Manually With 2019 And Earlier W4 Form

Online Tax Withholding Calculator 2021

How To Calculate Federal Income Tax

New W4 For 2021 What You Need To Know To Get It Done Right

Calculation Of Federal Employment Taxes Payroll Services

Calculation Of Federal Employment Taxes Payroll Services

Federal Withholding Calculator Shop Deals 44 Off Gnlifeassurance Com

Calculating Federal Income Tax Withholding Youtube

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form